Quantitative & AI Engineering Leadership

Quantitative & AI Engineering Leadership

Date published: 2024. Author: Philip Ndikum and Serge Ndikum.

Abstract:

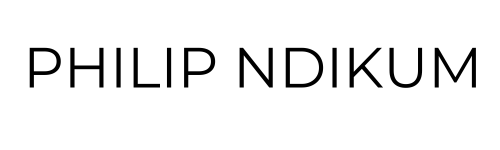

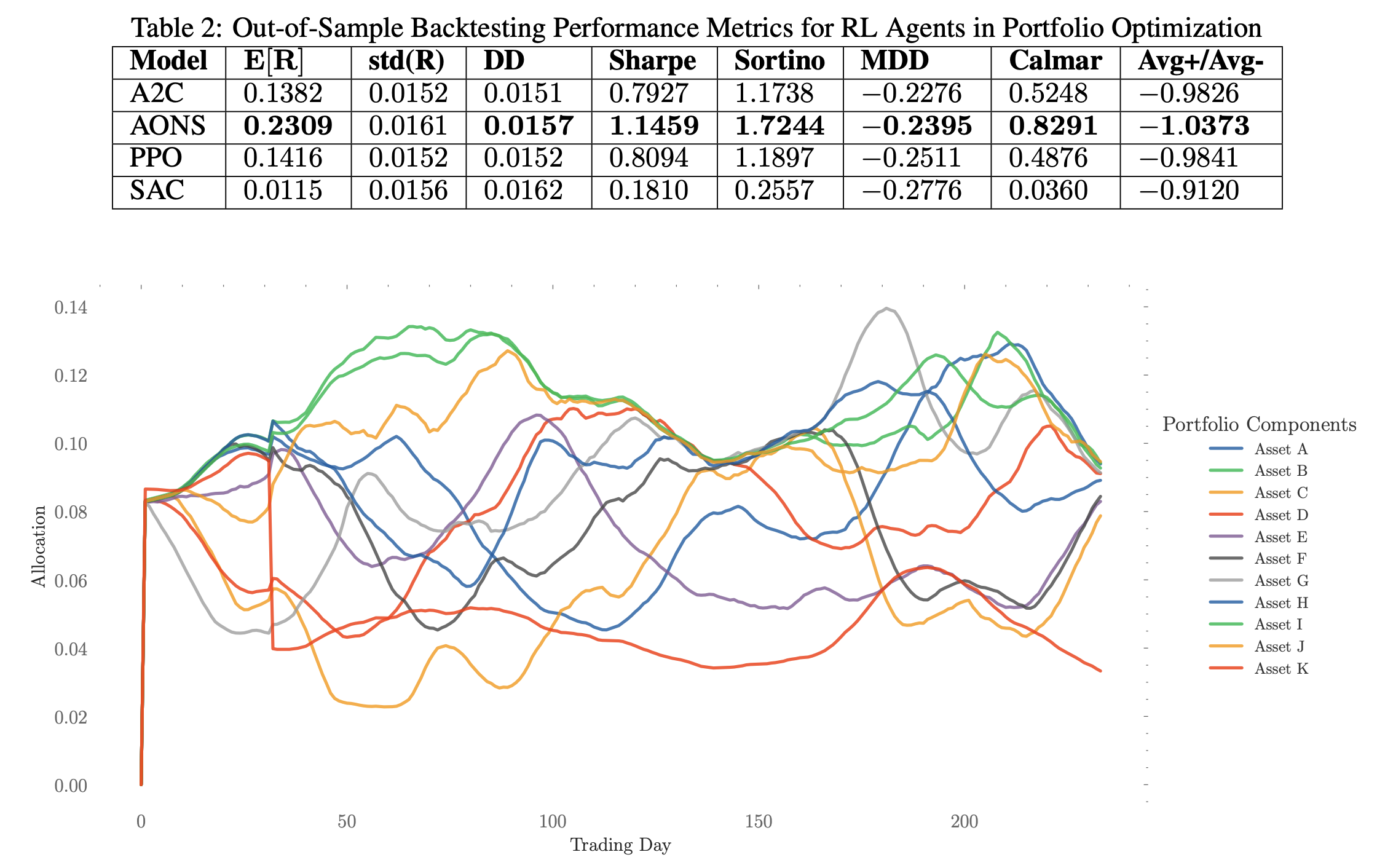

This research paper delves into the application of Deep Reinforcement Learning (DRL) in asset-class agnostic portfolio optimization, integrating industry-grade methodologies with quantitative finance. At the heart of this integration is our robust framework that not only merges advanced DRL algorithms with modern computational techniques but also emphasizes stringent statistical analysis, software engineering and regulatory compliance. To the best of our knowledge, this is the first study integrating financial Reinforcement Learning with sim-to-real methodologies from robotics and mathematical physics, thus enriching our frameworks and arguments with this unique perspective. Our research culminates with the introduction of AlphaOptimizerNet, a proprietary Reinforcement Learning agent (and corresponding library). Developed from a synthesis of state-of-the-art (SOTA) literature and our unique interdisciplinary methodology, AlphaOptimizerNet demonstrates encouraging risk-return optimization across various asset classes with realistic constraints. These preliminary results underscore the practical efficacy of our frameworks. As the finance sector increasingly gravitates towards advanced algorithmic solutions, our study bridges theoretical advancements with real-world applicability, offering a template for ensuring safety and robust standards in this technologically driven future.

This study pioneers the integration of Deep Reinforcement Learning (DRL) into portfolio optimization across diverse asset classes, positioning DRL as a transformative tool for the finance industry. By borrowing methodologies from robotics and mathematical physics, the authors introduce a robust sim-to-real transfer framework, addressing the challenges of applying DRL to financial markets with realistic constraints.

The centerpiece of the research is AlphaOptimizerNet, a proprietary DRL agent developed using a synthesis of state-of-the-art reinforcement learning techniques and rigorous software engineering practices. Notably, this agent achieves promising risk-return trade-offs, demonstrating practical efficacy when subjected to stringent performance metrics and regulatory compliance

Citation: Ndikum, P., & Ndikum, S., 2024. Advancing Investment Frontiers: Industry-grade Deep Reinforcement Learning for Portfolio Optimization. arXiv preprint arXiv:2403.07916.