Quantitative & AI Engineering Leadership

Quantitative & AI Engineering Leadership

Date published: 31 March 2020. Author: Philip Ndikum, University of Oxford.

Abstract:

This research paper explores the performance of Machine Learning (ML) algorithms and techniques that can be used for financial asset price forecasting. The prediction and forecasting of asset prices and returns remains one of the most challenging and exciting problems for quantitative finance and practitioners alike. The massive increase in data generated and captured in recent years presents an opportunity to leverage Machine Learning algorithms. This study directly compares and contrasts state-of-the-art implementations of modern Machine Learning algorithms on high performance computing (HPC) infrastructures versus the traditional and highly popular Capital Asset Pricing Model (CAPM) on U.S equities data. The implemented Machine Learning models - trained on time series data for an entire stock universe (in addition to exogenous macroeconomic variables) significantly outperform the CAPM on out-of-sample (OOS) test data.

Executive Summary:

This study evaluates the effectiveness of Machine Learning (ML) algorithms for predicting financial asset prices, a core challenge in quantitative finance. Leveraging large-scale financial data and high-performance computing (HPC), the research contrasts state-of-the-art ML techniques against the traditional Capital Asset Pricing Model (CAPM) using U.S. equities data. Results demonstrate that ML models, trained on time-series data and macroeconomic variables, significantly outperform CAPM in out-of-sample (OOS) tests, showcasing their potential in financial forecasting.

Key Insights

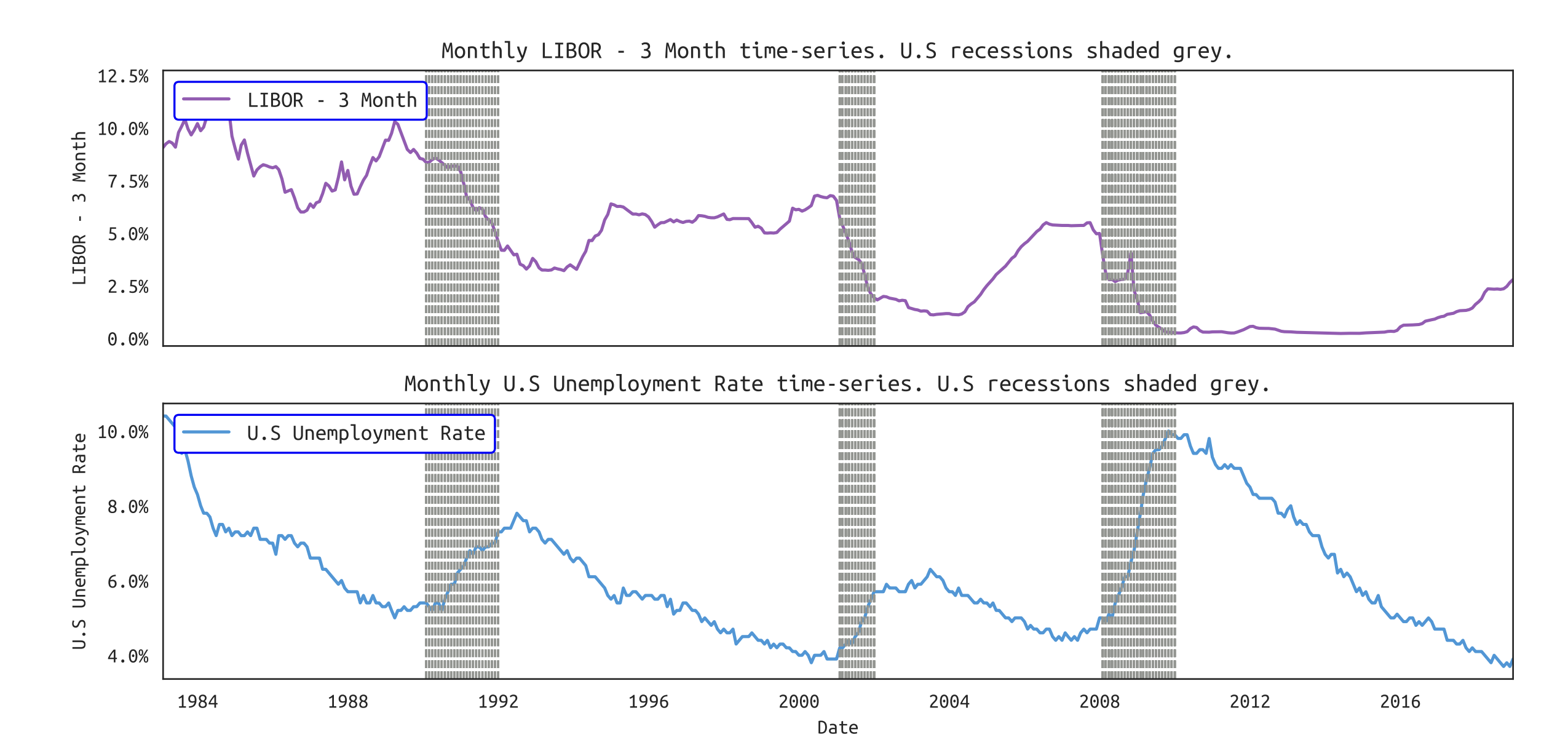

In 2020, this paper explored the application of machine learning algorithms to the challenging task of financial asset price forecasting. This period marked a turning point for the finance industry, driven by rapid advancements in computational power and the increasing availability of high-quality, large-scale financial data. The study utilized high-performance computing infrastructures to implement cutting-edge machine learning techniques, including gradient boosting trees and neural networks, to analyze time-series data and macroeconomic variables. These approaches were shown to significantly outperform traditional methods such as the Capital Asset Pricing Model (CAPM) in predicting U.S. equity returns, emphasizing the potential of modern machine learning in financial econometrics.

Furthermore, the research highlighted the importance of transparency and interpretability in algorithmic models, particularly in light of emerging global regulatory frameworks such as GDPR and MiFID II. These frameworks underscored the need for financial models to be explainable and compliant, setting a benchmark for responsible innovation in quantitative finance. By integrating macroeconomic exogenous factors into machine learning models and addressing the complexities of high-dimensional datasets, this study laid the groundwork for the next generation of financial data science applications.

Cite: Ndikum, P., 2020. Machine learning algorithms for financial asset price forecasting. arXiv preprint arXiv:2004.01504.

Legal Notice: This content is provided for informational purposes only and does not constitute financial advice, investment advice, or legal counsel. All methodologies discussed are subject to applicable regulatory requirements, and their implementation should comply with local and international laws.